In Taking Inventory of Your Skill Set – Part 1, we discussed three groups of skills :

- Job skills, which are needed to acquire a particular job, keep it and then to elevate one’s standing within a company (i.e. job promotions and raises).

- Life skills, which are needed to navigate everyday life–not only in our personal life but also in the workplace.

- Personal Life skills, which are necessary for our fulfillment of life – friendship, responsibility, patience and so on.

Ladies, if you want to make more money in order to help yourself achieve financial independence, you will have to understand how to make yourself qualified for current and future job openings.

To do this, let’s figure out exactly what employers are looking for. We all know the basic law of supply and demand, which defines the effect that the availability of a particular product (or resource) and the desire (or demand) for that product have on its price. In this case, the price will be your future salary.

In order to know what price to negotiate, we must evaluate the availability of the resources and skills we bring to the metaphorical table, particularly the resources and skills that are in “shortage” (and which therefore are also in demand) within the job market.

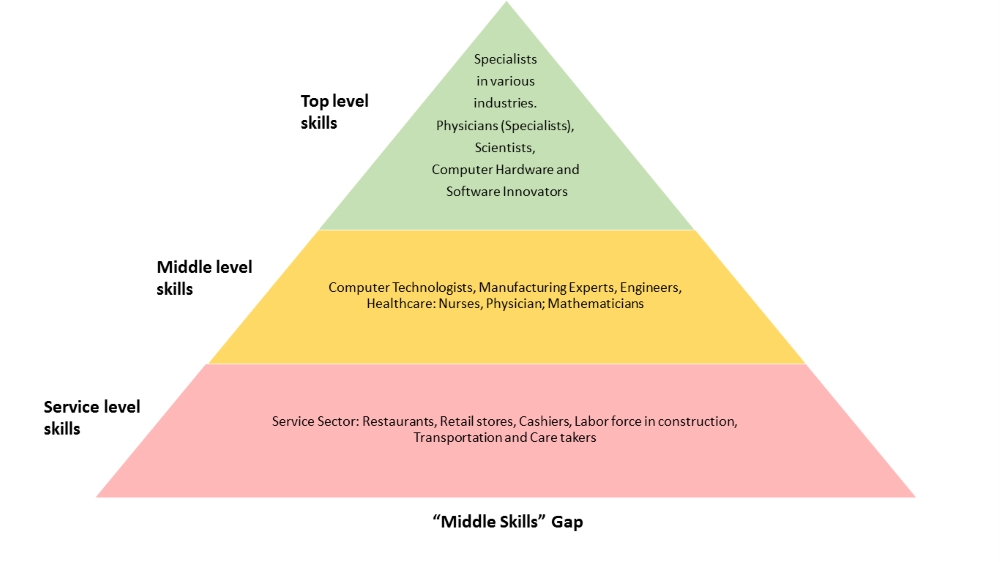

Harvard Business Review has coined this gap as the “Middle-Skills Gap”. My interpretation of why this is called “Middle Skills” is reflected in the slide below. It is absolutely not a value judgement, but is more an attempt to classify the three main groups of professions visually.

Generally speaking, middle skills jobs are aggregated from computer technology, health care (e. g. (as example) nursing), high-skill manufacturing and other technical fields. More often than not, these types of jobs require skills that are picked up in post-secondary technical education institutes, as well as training. Most computer technology and high-skill manufacturing require college math courses and degrees. Currently, about 69 million people work in middle-skills job in the US, representing roughly 48% of the labor force.

Quoting HBR December 2012 “Who Can Fix the “Middle-Skills” Gap?” [su_quote]Although the U.S. Bureau of Labor Statistics doesn’t publish estimates of job openings by skill category, combining government data on education and training requirements leads labor market experts to estimate that as many as 25 million, or 47%, of all new job openings from 2010 to 2020 will fall into the middle-skills range. (See the exhibit “The Middle-Skills Employment Landscape.”) [/su_quote]

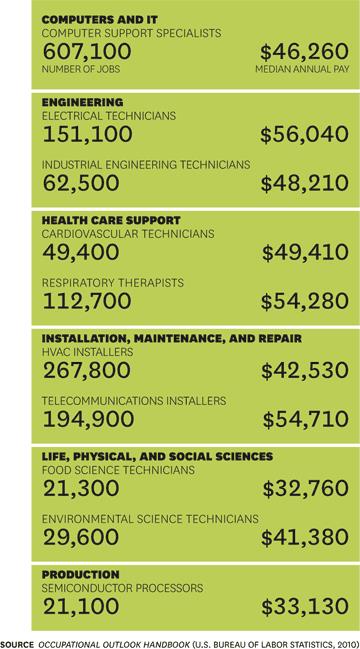

The Middle-Skills Employment Landscape

Here’s a small sampling of middle-skills jobs in six occupational groups in the United States:

In the U.S., demand for people with liberal arts degrees has declined sharply in the past two decades. I would guess that this is also the case world-wide. In spite of this though, only 15% of US college graduates major in science, technology, engineering or math (STEM). For whatever reason, this percentage has remained the same for the past two decades.

What does this mean for you? Well, you’d better start taking more mathematics courses, while learning more computer technology basics. The internet can be a wealth of knowledge and being able to tap into it is a vital skill these days. Of course, this includes knowing how to use a laptop.

If you can’t afford a laptop at the moment, head to your local library and utilize the computers there. Don’t buy any unnecessary purchases for the next six months and you’ll be surprised how much you have saved. Use this money to buy a laptop.

In this post, we talked about what qualifications were necessary in high-paying jobs, including:

- Communications Skills

- Analytical Skills

- Computer/ Technical Capabilities

- Multitasking

- Interpersonal Communications Skills

- Being a Manager/Leader

While all of these skills are important to have, honing your analytical skills and computer/technical skills are key to helping you land a great job.

As I said above, having a laptop of your own to practice/develop your skills will help a LOT with this. Also, if you don’t already have one, please get an associate’s degree, as this increases earnings by an average of 13% for men and 39% for women.

So what does this mean for you? Let’s take a look at another excerpt from the aforementioned Harvard Business Review piece:

“For-profit, nonprofit, and public universities, including those in the top tier, are offering or developing exclusively web-based degree and certificate programs. For example, Stanford, Princeton, and the University of Michigan are members of for-profit Courses, and MIT, Harvard, and the University of California, Berkeley, are involved in edX, which creates free online courses. This movement represents a breakthrough in broadening access to education worldwide, and employers should seize the chance to help shape it to meet their needs.”

According to Harvard Business Review statistics, people finishing community college programs and landing a middle-skill job could raise their annual earnings by an average of $10,000.00 (ten thousand US Dollars).

That bump in salary is a big step forward towards your goal of achieving financial independence in the long-run, no?

Check back next week for more financial advice and career guidance from yours truly.

Other Resources –

Leave a Reply